How Monetization Product Managers Think About Pricing & Monetization Design

The search for the Holy Grail of Ai Monetization is on. But to find it, you'll need a map and a compass.

Map and Compass

I've been away.

Thinking. Struggling. Failing.

Try as I might, I've often struggled to really explain Pricing and Monetization to my clients.

Sometimes, I'm close, and they break through.

Other times. Well, nothing.

It's one thing to carry out the project.

But, it's another to enable the client to never need another pricing consultant again.

Or, at least not for a while!

This is the ask.

Feed someone fish vs teach someone how to fish.

Or whatever the actual cliche is. You know what I mean.

So the question we ask is:

Is it that difficult?

Or am I just explaining it poorly?

Maybe. Maybe both? Who knows!

But either way, I needed to go back to basics:

Basics that work from the ground up.

Basics that act as a protocol for increased learning

Basics that enable someone to Start and Finish a Pricing Project.

How To Solve A Problem Like Monetization

Everybody Prices, but no one likes Pricing Profession.

Why?

Let's consider three of the main problems with the perception of the Pricing.

Jargon Overload. Outsiders feel alienated and can't map it to their business reality. There's too much insider language (e.g. CAC, LTV, net retention, usage-based Pricing).

Tactical, Not Strategic. Pricing and Monetization are seen as tactics. But should be viewed as part of strategic design to create and capture value.

No Emotional Hook or Urgency. Pricing is presented as a spreadsheet exercise, not a growth or survival issue.

I Like Frameworks

Yes. Yes, I know. Frameworks are the most overused tool in the product management and design arena. But not so in the world of Pricing and Monetization.

And there's a reason frameworks are so popular. They're mental models. And who doesn't like mental models?

So let’s introduce the first framework that will help act as a map and compass to Ai Monetization.

The Value Creation Value Capture Hierarchy

If you can calculate 'Value Creation', you can negotiate 'Value Capture.'

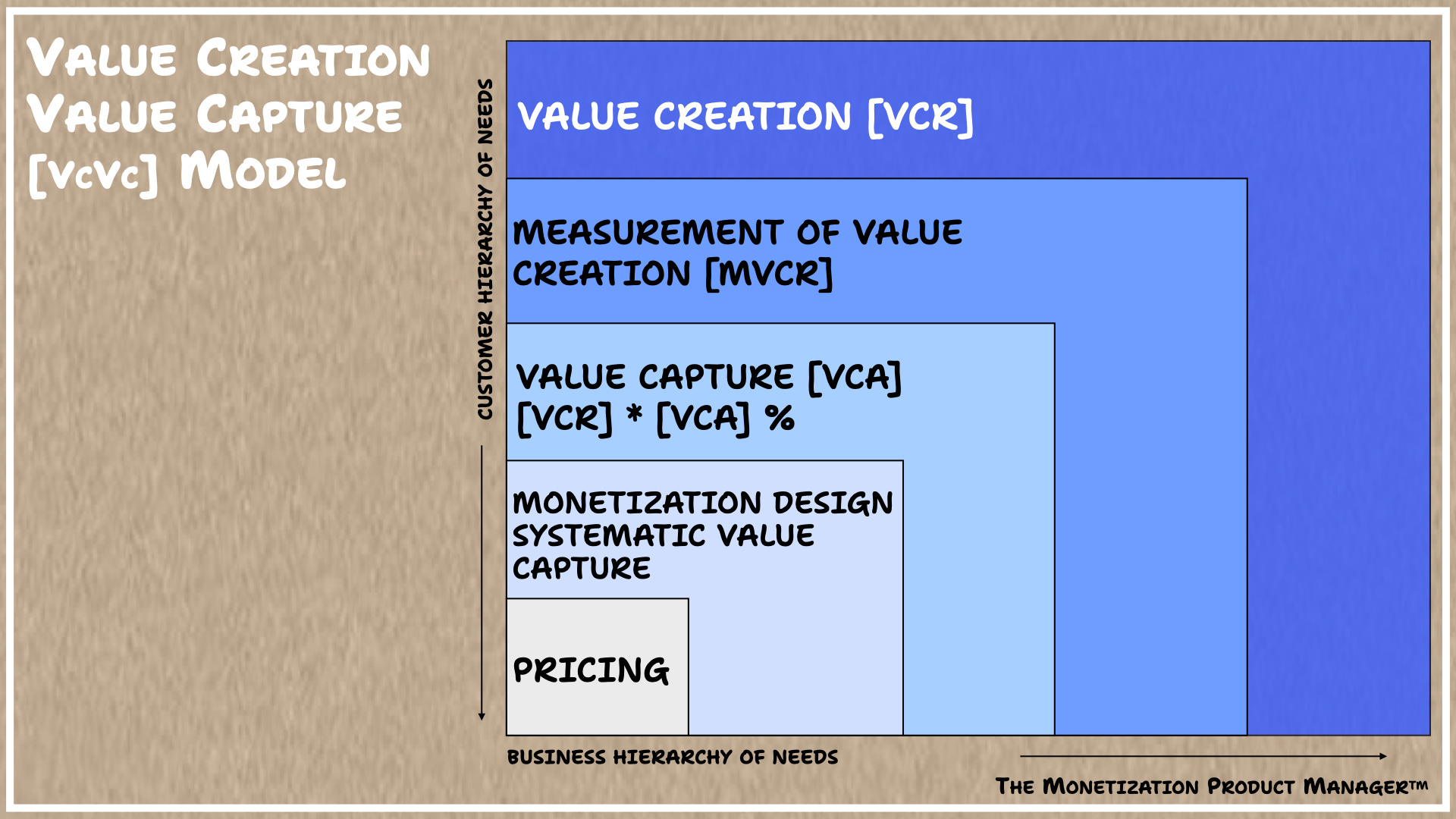

Value Creation Value Capture Hierarchy

The first framework is the most important yet mostly underused concept. This is in part due to the fact that we focus on the lower end of the stack.

Pricing is always first on people's lips. Monetization and Value Capture barely get a mention.

But Pricing is a result.

Not the cause of good monetization.

So back to it.

The Value Creation Value Capture Hierarchy:

Step 1 - Value Creation

Step 2 - Measurement of Value Creation

Step 3 - Value Capture

Step 4- Monetization

Step 5 - Pricing

One: What is Value Creation? [VCr]

In business, value is created by the benefits of a product or service that exceed the costs (or price to the customer).

Two: How Do You Measure Value Creation? [MVCr]

This is the calculation of the value creation from above.

Three: Value Capture [VCa]

This is the percentage amount of value you can capture from the value you created.

[VCr] * [VCa] percentage %

Four: Monetization

This is the system for collecting that Value Capture.

The Value Capture Design.

Five: Pricing

This is the expression of your monetization into an easily understood unit.

For example: per seat, per unit, per month, per task, per work, per outcome

The foundation of all Monetization and Pricing is Value Creation.

If you can create value, you have a chance of capturing some of it.

Following on from 'Your Pricing Project: Part One,' we need to briefly discuss the concept of value creation.

I say very short as, in reality, this is a 'Hand Wavy' type of subject.

It means something. And nothing.

All Startups talk about 'Creating Value'.

But very few can measure it.

So, to avoid adding to this fuzz, we'll keep it simple.

What is Value Creation? [VCr]

Value is created when a product or service's benefits exceed its costs (or price to the customer).

In short, the Product's Benefits exceed its Costs.

[Product Benefits are greater than > Product Costs]

Or

[Service Benefits are greater than > Service Costs]

Gross vs Net Value

One of my favourite VCs, Kyle Harrison [yes, that's a thing, now], talks about Gross and Net Value Creation.

He explains that we tend to look at things only through the buyer and the supplier lens.

But rarely take into account any other secondary parties.

Gross Value Creation is every customer benefit derived from a particular product or service.

Net Value Creation takes into account the negative externalities as well.

For example, Scooters benefits both the user and the Scooter company. But it led to negatives for other pedestrians having to step over bikes strewn all over the pavement.

Ditto E-Bikes.

And the list goes on!

Dogs benefit owners and the dog. But dog waste is a negative externality.

To keep it simple, we'll talk about gross value creation.

Value that which can be measured.

How To Measure Value Creation? [MVCr]

How much?

This question bedevils all businesses.

How much to charge?

How much resources do you need to deploy?

How much value have we created?

How much value can we capture?

The question of how much is the crux.

The crux of the strategy.

The crux of the business model.

And the crux of success!

But what is value creation?

We've talked about how value creation is the process of enhancing the value of a product, service, or thing such that its value exceeds its costs.

But how do you measure that?

But before we dive down the rabbit hole of value creation measurement, let's ask why measuring is essential in the first place.

Most companies think they have a monetization problem.

But what they have is either one or all of these problems:

a. a value creation problem

b. an ability to measure that value creation

c. an inability to communicate that value creation to customers or clients

Monetization rests on the shoulders of the creation, calculation and communication of value creation.

The Measurement of Value Creation

Let's go through five main measurement models:

The Skills Agency Model

The Cash Take Transformation Model

The Resource Optimization Model

The Assurance Model

The Marketplace Model

The Skills Agency Model Measurement Model

The skills agency model is perhaps the simplest.

I give you a plum, and you 'return me a peach' kind of thing.

In this sense, the plum is generally cash or spend, and the peach is a return on that cash or spend.

Digital Advertising Agencies are the best example of this measurement model.

$100 given to a skilled Meta/Facebook agency should result in $300 of revenue. That's a 3X return.

Or, a $200 incremental return is another way to put it.

This measure is, therefore, clean and easy.

I give you $100, and you give me back $300.

$200 of value creation.

The Cash Take Transformation Measurement Model

The Cash Take Transformation Model is equally as simple. They take cash from one form and deliver it to another.

The best example is a Visa card.

Visa takes your money and transforms it into the same or foreign currency to deliver to a third party. Say, a retailer or vendor.

A $100 transaction represents $100 of value creation for the vendor. A sale that they may not have made without the Visa card enablement.

Resource Optimization Measurement Model

The Resource Optimization Model relies on creating value by improving the use of an existing asset.

This applies to any capital. Think talent capital, physical plant capital, cash capital or equity capital.

This is where most software lies, particularly productivity software such as Excel, Notion, Powerpoint, etc.

But the best example of this category would be ERPs. Enterprise Resource Planning software such as SAP.

They create value by enabling you to run payroll or manage assets better.

For instance, if you're managing $100m in assets/resources and planning helps you optimize by just 1%, they've delivered $1m of value creation.

Assurance Measurement Model

Risk management is valuable. Value is created by negating these risks.

Insurance is the best example of value creation by negating threats.

Value is created by allowing you to conduct a certain type of business activity in the knowledge that extreme downside risks are covered.

Cyber Security is another great example of how assurance can provide huge value creation and capture.

Marketplace Measurement Model

The goal of a marketplace is to reduce transaction costs, which are the transaction costs of supply meeting demand, sellers finding buyers, and the reverse.

Reduced transactions create value for one or both parties. The costs of these transactions could be time, stress, money, etc.

Summary

The measurement of value capture is the most important step in your monetization project.

And How Much of That Value Created And Measured Can You Keep For Your Business?

Sic Semper Tyrannis!

No, I can't speak Latin either.

But, it is a fitting intro to explain value capture.

It translates to something like 'Thus Always To Tyrants'.

It suggests that tyrannical leaders will eventually be overthrown.

Maybe that’s true.

But Monopolies persist quite a bit longer than most tyrants!

Value capture depends on the power of the capturer.

And the weakness of the captured.

Thus, value capture levels vary depending on the supplier vs. buyer power level.

As such, there is no one level but a range.

Here are a few value capture examples:

Comparative value capture relative to the value created:

Resource Optimizing Model (e.g., SAP, Productivity Tools) - Less than 1%

Money Delivery Model (e.g., Visa, Investment Management) - 2-2.5%

Skills Agency Model (e.g., Digital Marketing) - 10%

Risk Mitigation Model (e.g., Insurance, Audit, Consulting) - Less than 2%

Marketplace Model (e.g., AppStore, Amazon, AirBnB) - 10-30%

As you progress through building your monetization model, you'll look at ways of increasing your value capture through monetization architecture and design.

What is the Monetization Model Map?

Intro: After imbibing hundreds of startup, investment, pricing, growth, SaaS, marketing, behavioural science, math and sales books, podcasts, videos and blog I thought to myself “there must be a pattern to this monetization game”.

Why does it seem so unstructured?

There is a pattern.

Here it is. An 8 step map to monetize your startup, business or non profit.

Monetization Model Map Explained:

Step 1. Monetization Psychology

Why you charge: Intrinsically where your company, product or service is positioned from a mindset perspective. Partner or Hire, Need or Wants.

Step 2. Monetization Orientation

Who you charge: Charging methodology levered directly towards all beneficial users or a particular type of user or just the economic buyer.

Step 3. Monetization Strategy

How you charge: On a value based or anchored metric such as cost plus or market pricing.

Step 4. Monetization Models

How you charge: Charging model and use relationship. Outright one off, perpetual, recurring.

Step 5. Monetization Packaging

What you charge: Solo product or service or packaged - selective or all you can eat bundles.

Step 6. Pricing Tactics

What you charge: Pricing tactics. Approaches including skimming, penetration, price differentiation, maximisation & auction.

Step 7. Monetization Channels

Where you charge: Avenues that deliver monetization. Digital or physical, directly and via 3rd parties.

Step 8. Monetization Execution

When you charge: Execution of monetary capture and collection, review and overall management of the monetization techniques. Pricing surveys, market data and feedback into monetisation plans.

Follow this 8 step framework to build your Monetization Architecture.

You can get more on this and the 24 Laws of Monetization here.

Pricing is a Product?

Hear me out.

If Pricing is a Product.

Products need to be designed.

And then engineered.

And then explained to users in the simplest way.

If all these are true.

Then prices, like products need to be designed.

Designed to be simple. And easy to understand.

The goal of your pricing project is design.

Designing a price that is:

Simple

Easy to understand

And

Translates the monetization model into a unit.

Pricing is the final foundational piece of the value creation value capture hierarchy, but it is the result of all the frameworks applied above.

That’s it.

A Map and a Compass to start your monetization and pricing treasure hunt.

Post Script.

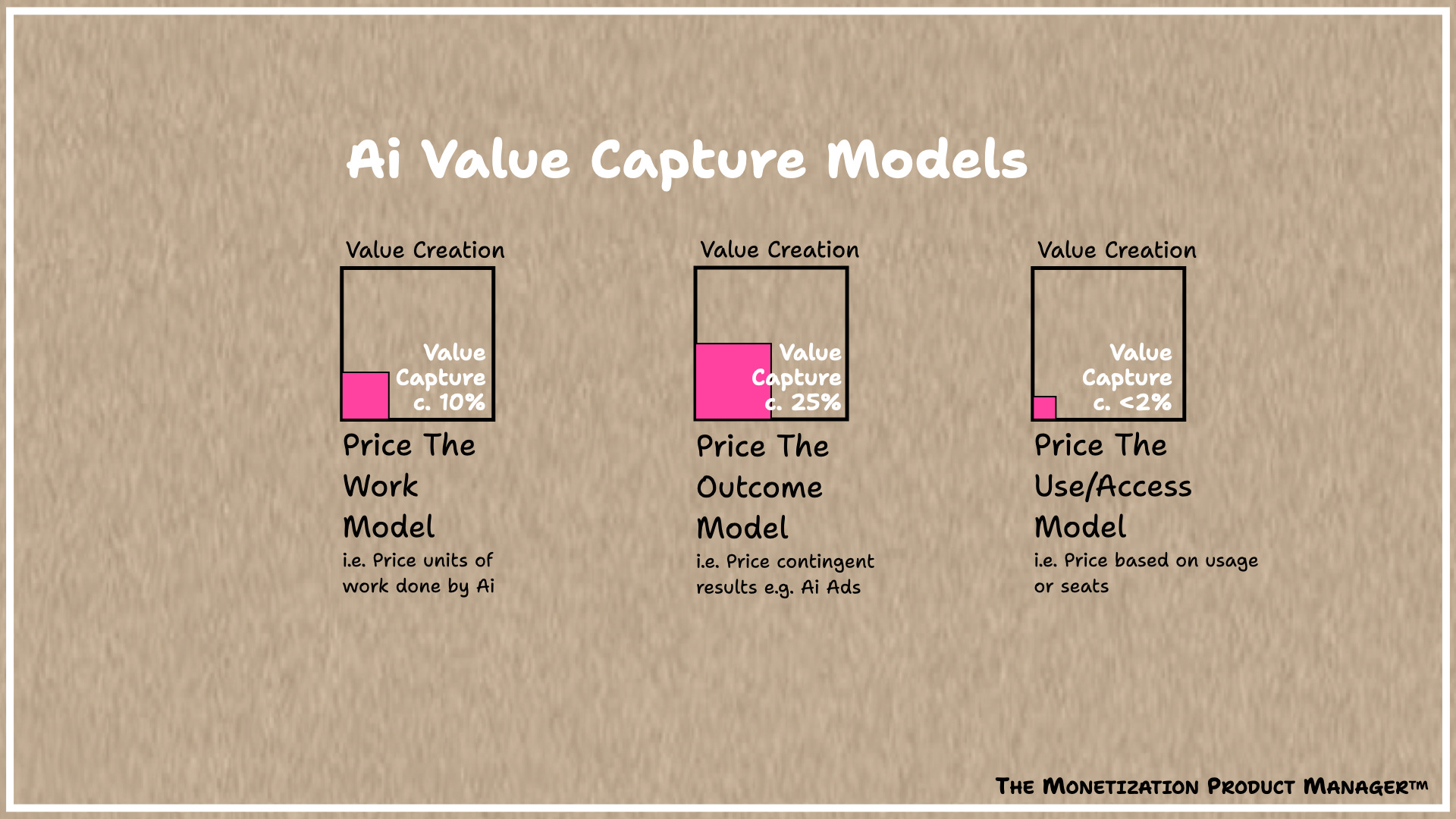

Emerging Ai Value Capture Models

In the last 24 months or so since ChatGPT splashed across our screens, there’s been a glut of new ideas about how value will be captured.

Today, there are a number of different methods that Ai and SaaS companies are employing to capture some of the value they create.

At a high level it boils down to just three main contenders:

Price The Work Model

i.e. Price units of work done by Ai

Price The Outcome Model

i.e. Price contingent results e.g. Ai Ads

Price The Use/Access Model

i.e. Price based on usage or seats

As you can see, the estimated value capture percentages vary. This is the struggle that most Ai companies have. Do they price for use or access as most are doing now? But in the knowledge that this is a race to the bottom of the red ocean.

Or do they seek to price the outcome and take home the treasure before clients make them to walk the plank.

The game is on.

Happy to talk through monetization design with anyone, anywhere, anytime. That should be an Ad, shouldn’t it!