Salesforce: ‘The Bundled Monetization’ Trap

Why Salesforce’s greatest monetization weapon is also its biggest AI liability

TikTok Commentator

“Salesforce exists because of one reason: when a sales person leaves, the company still has all the customer contacts. In the old days sales people took their address book with them.”

Now, I’m sure that Marc Benioff isn’t crying into his Kombucha trying to reorient his strategy around a TikTok Strategy influencer, but he may admit that there’s some truth to it.

A Conflict of Visions.

Salesforce is punting AI Agents. And Microsoft is backing Co-Pilots. It’s hard to tell who’s right at the minute. But, from a Monetization point of view, AI Agents offer more revenue wiggle room.

The key question is: Where is the ‘Customer’s Centre of Gravity’? I mean, which act or action will be ‘ground zero’?

For instance:

Adobe’s Centre of Gravity is ‘Integration across a creative ecosystem.’

Whereas Figma’s ‘Centre of Gravity is…Collaboration-first workflows.

Every business has a 'Monetization Centre of Gravity'.

The one lever that defines how revenue:

- flows

- scales, or

- stalls.

Yet, most don’t know how or where to find it.

Why? Because it’s hard to find!! Marc Benioff is betting that AI Centre of Gravity is AI Agents. Software as a Service morphs into Agent as a Service.

A A A S is big. Or, at least, Marc hopes it’s going to be big.

The centre of gravity for early SaaS was and still is the employee. For later SaaS, it shifted to workload or usage.

Salesforce is betting the next shift will be to ‘Agent Jobs.’

SaaS Questions

SaaS leaders face many questions. But we can boil these down to just three or four paths:

Stay exactly the same. "I'm SaaS 'till I die" kind of thing

Add new AI products that complement existing SaaS offerings.

Re-configure existing products into Ai Agents gradually.

Immediately switch to Ai...Burn the boats kind of thing.

Now, we know option 4. is never gonna happen. That's the realm of startups.

So we can focus on options one to three.

Most SaaS will choose option 1. And that's cool. No one ever threw a database out of bed, as they say.

Options two and three are where the action is at.

Most SaaS is busy adding new AI features and products.

No one has cracked it yet. But Salesforce looks like it wants to move to Agents...one step at a time.

So. Can an AI startup ever beat a giant that is prepared to re-orient the ship to AI? Let's run the game and see.

Here’s how a Monetization Product Manager would noodle on the hidden problems facing Salesforce since the emergence of AI.

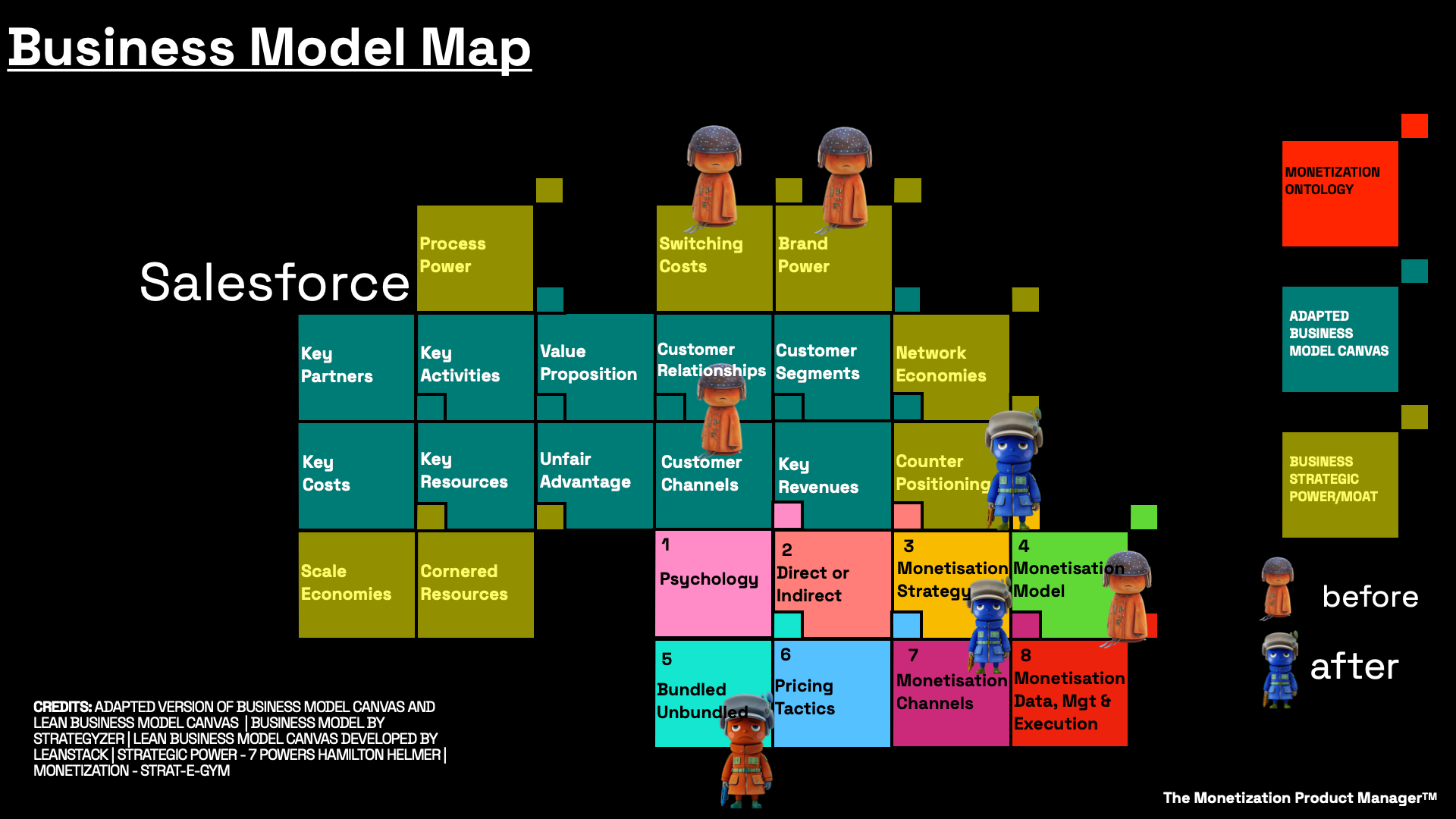

Diagnosis of Current State

While not exhaustive, some of these issues should be top of mind for a monetization product manager when looking at Salesforce today.

Platform Bloat & Feature Fatigue: Product complexity outpacing user needs; customers overwhelmed.

Ecosystem Lock-In Risk: Revenue highly reliant on enterprise clients locked into CRM suite—threat of modular AI tools bypassing the suite.

AI Integration Anxiety: Rushed embedding of AI (Einstein, GPT) lacks credible use cases and feels like marketing-led innovation.

Sales Efficiency Decline: Increasing CAC and S&M spend; margin pressure rising despite scale.

Org Structure Inertia: Matrix org not agile enough to compete with product-led SaaS startups and AI-native platforms.

All of the above are factors but you could argue that ‘The moat has become the cage’. Salesforce monetizes through full-suite lock-in, but that model is under pressure as best-of-breed AI tools offer modular, cheaper alternatives.

Their TAM will be attacked by horizontal AI platforms offering componentized intelligence (e.g. Gong for sales insight, Notion for CRM-light use cases). Their Strategy has not adjusted to defend this flank with modularity or open data portability.

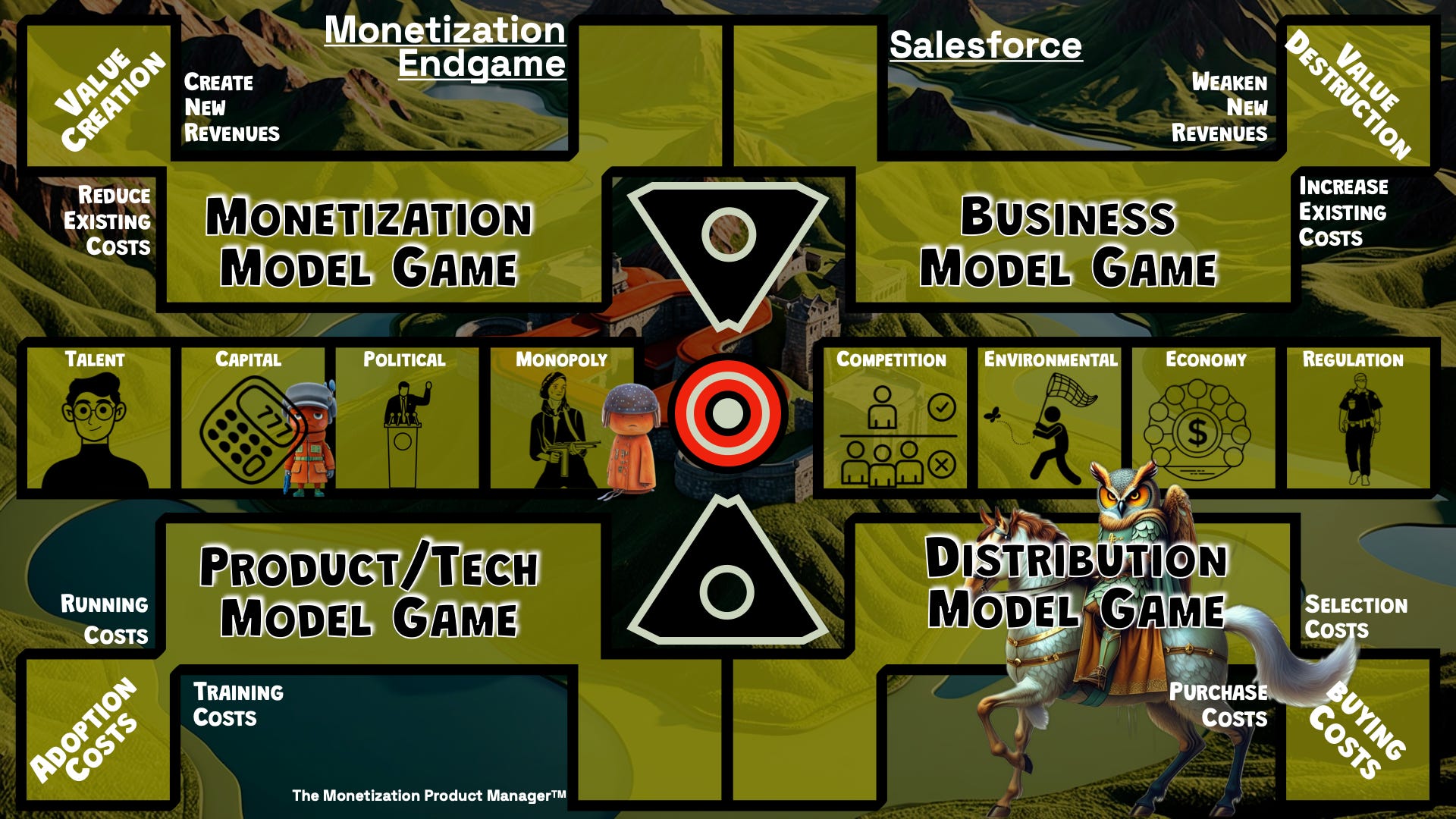

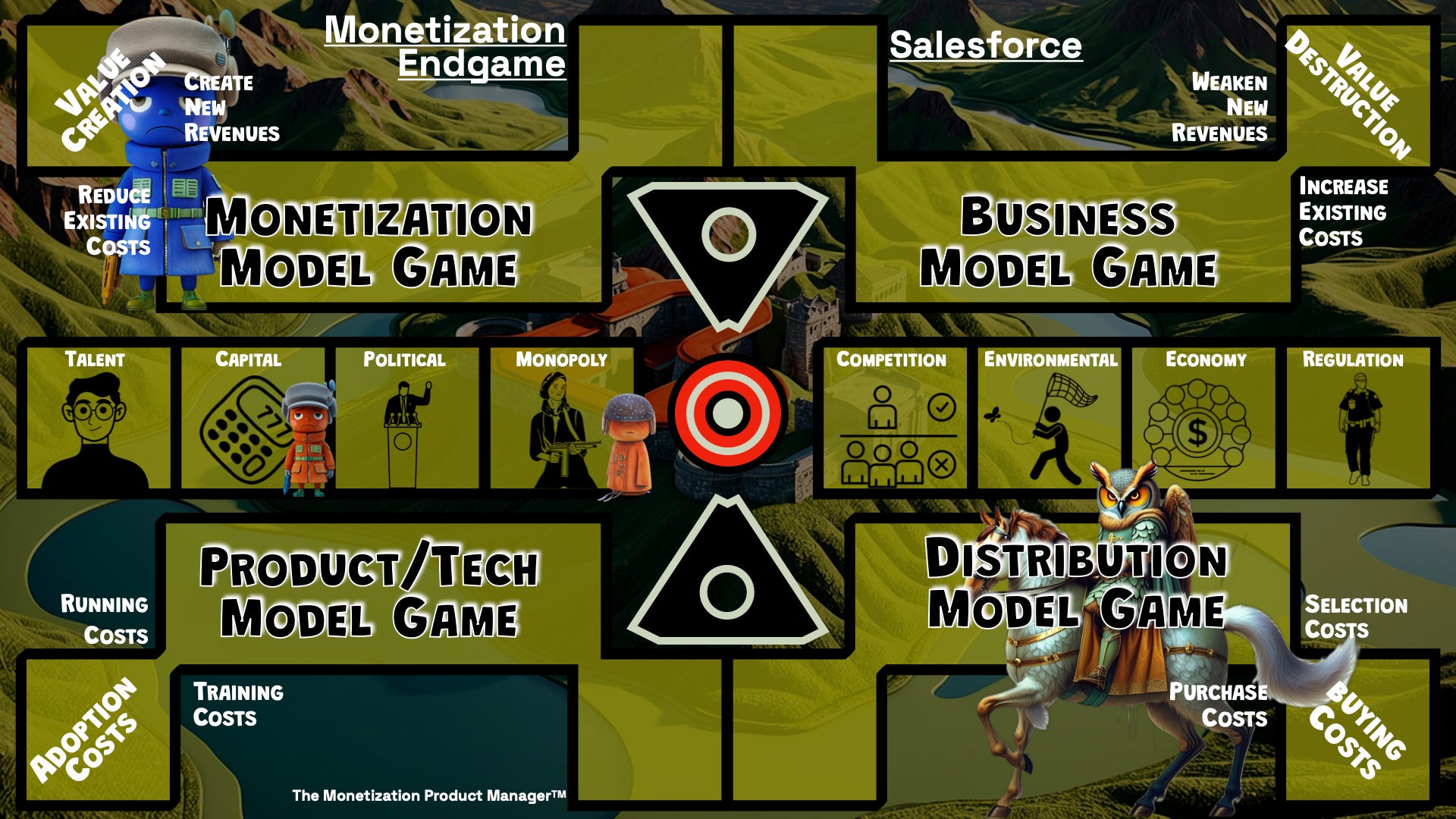

So What Monetization Endgame Are They Playing?

Salesforce’s dominant game is Distribution. With a huge salesforce, no pun intended, they’ve sought to further enhance this distribution with product acquisition ‘tuck-ins’ such as Slack, Mulesoft and Tableau to sustain new revenue pools from bundling more products into its platform. As opposed to core tech innovation.

It's capturing value through scale, bundling, cross-sell—not product novelty or monetization model innovation. And while it would be unfair to mention the monopoly word, they do have a strong moat with customer relationships and brand awareness that help bolster its AppExchange and drive partner certifications. Their eco-system game is strong.

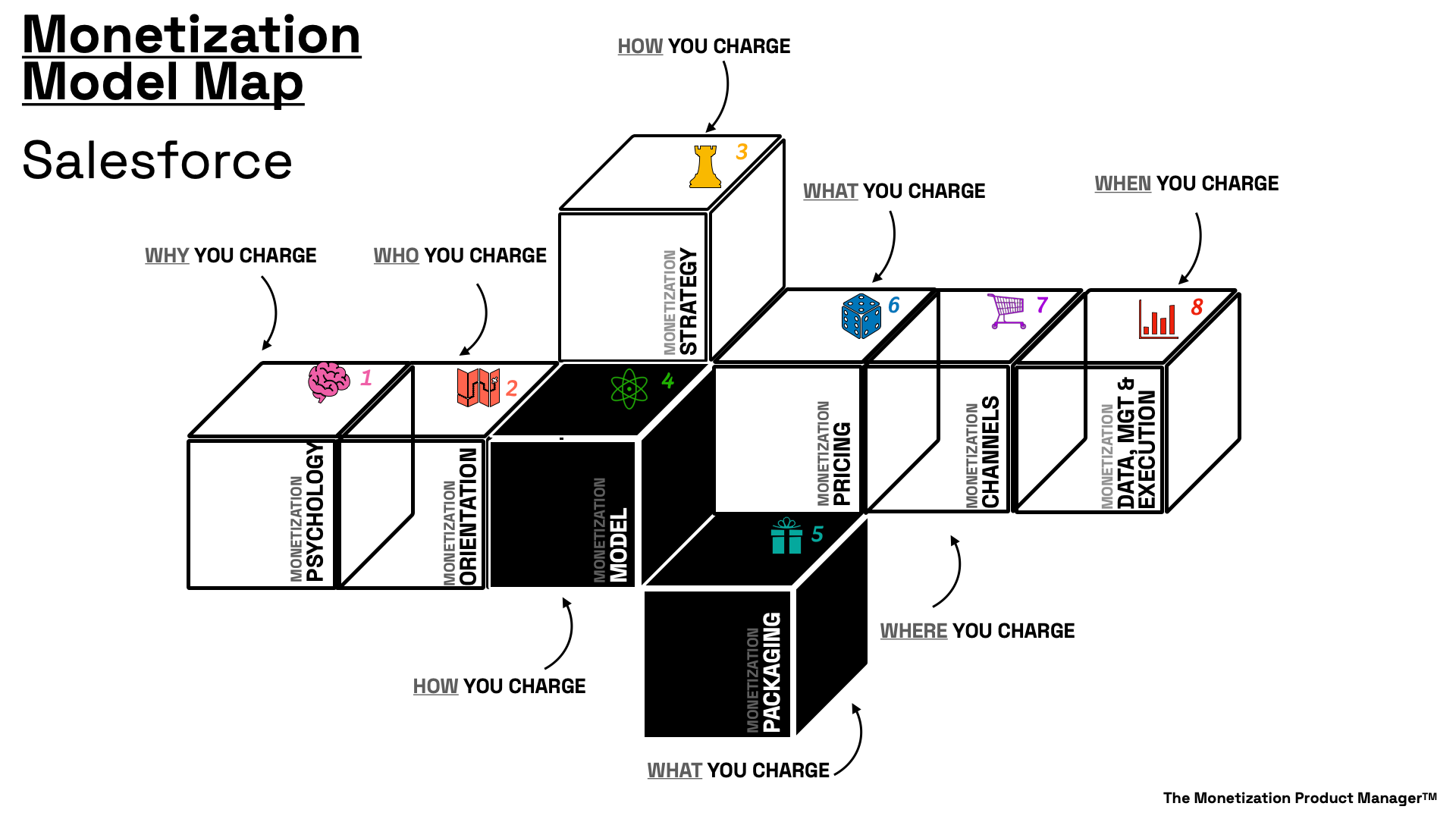

On The Monetization Front

To my mind, Marc Benioff is Mr SaaS having been the greatest exponent of the SaaS Cloud transformation. As such, to this day, they deliver a masterclass in monetization model subscriptions and monetization model packaging with Sales, Marketing, Services, Tableau and Slack all available in the buffet offering.

Non Obvious Observations

A. Their moat is data—yet it’s not that defensible.

Salesforce doesn’t own the transaction layer or full customer journey; their data is mid-funnel (CRM). GPT-style LLMs trained on open web + company emails (via integrations like Gmail/Outlook) can replace parts of Salesforce without needing its data. This makes them vulnerable to AI-native vertical SaaS.

B. Their pricing logic works against AI value

The seat-based pricing doesn’t match AI’s value creation vector (automation, not human activity). AI that removes user seats (via automation) destroys their monetization logic

C. Internal M&A creates integration drag

Acquisitions like Slack and Tableau haven't yielded coherent monetization synergies. Internal org friction slows GTM synergies—opposite of what bundling requires.

D. They’re not truly a tech company anymore

Product innovation lags. Revenue model innovation dominates.

So What Monetization Endgame Should They Be Playing?

To be honest, almost a year has passed since Marc Benioff went on his Agent Ambition tour, so this one is no secret. Salesforce is attempting to change from a pure Distribution game to a Monetization game. So what is a monetization game. Good question. A monetization game is where your pricing and monetization are counter-positioned to the market. For example, the dominant charging model for CRM SaaS is per seat. Salesforce have flipped this and are pitching $2 usage based agents. To be fair, this a brave move from such a big company, but Marc is no slouch and sees the per seat model writing on the wall.

So how’s it going?

Reports have been mixed. Some customers love it, others not so much. But the genie is out, and I’m not sure if anyone will sit it back down on a seat.

More Importantly, What Does This Mean For A Monetization Product Manager?

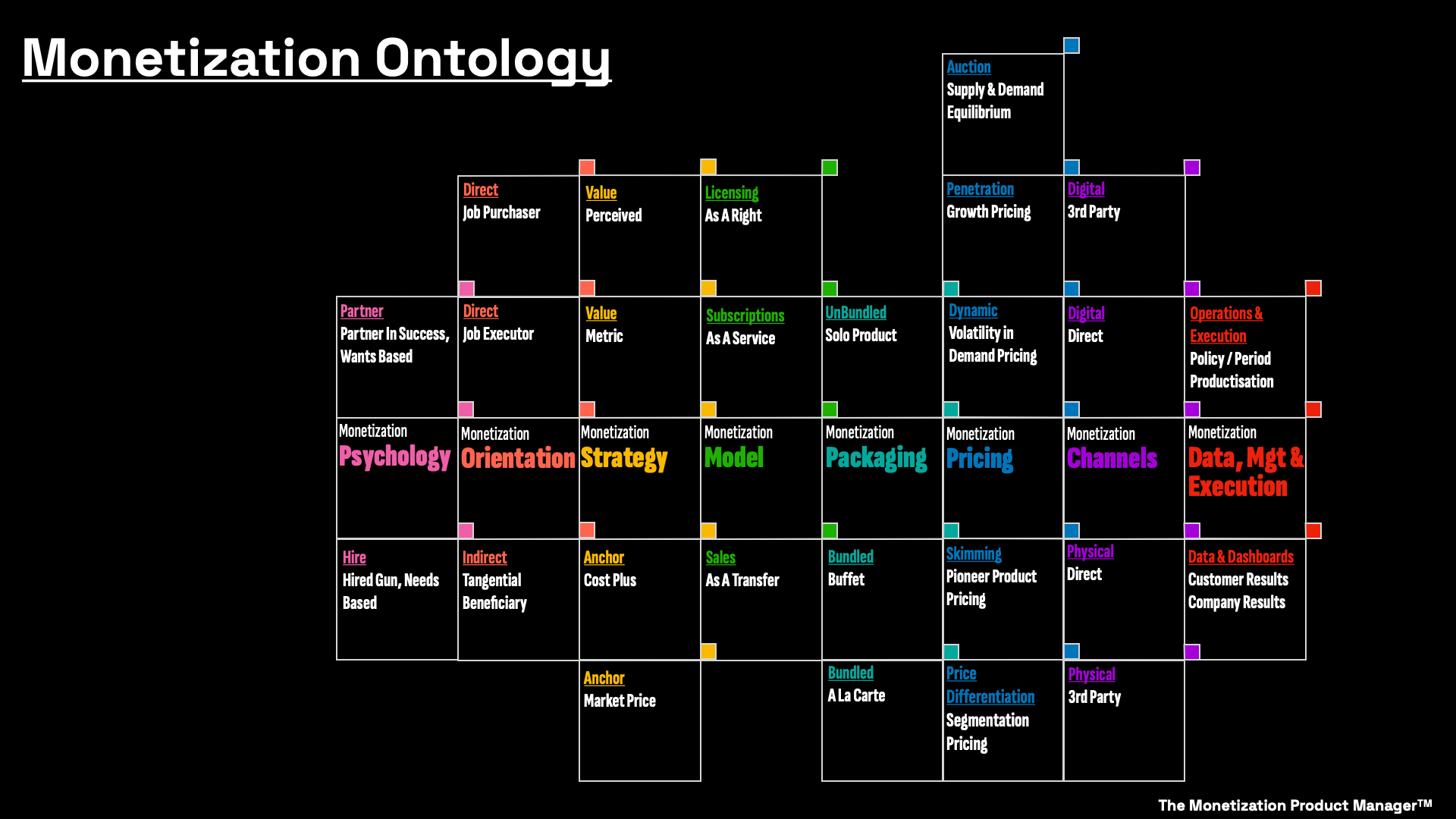

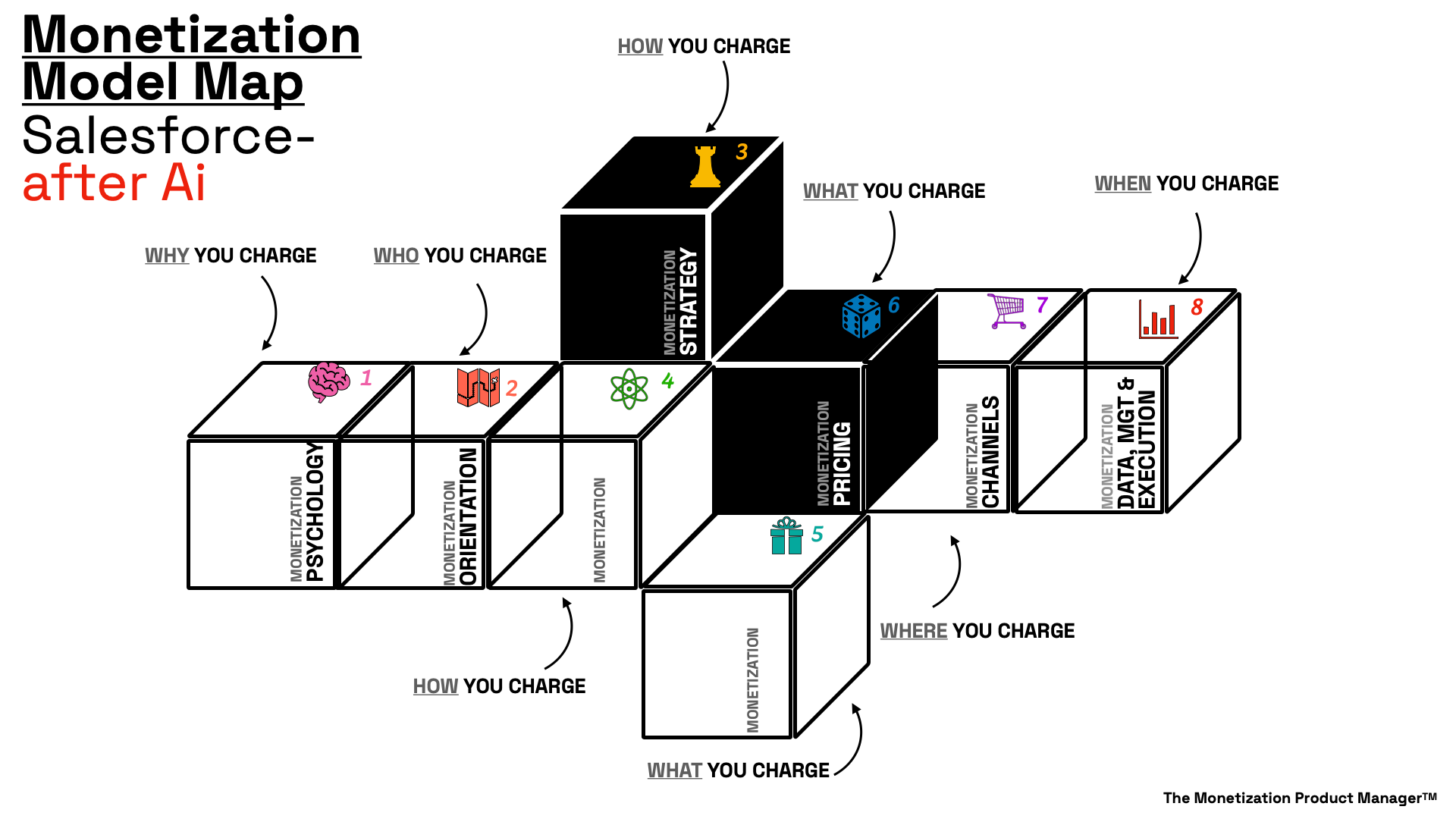

A new game means a new approach. In the per seat model, the key monetization model segments were monetization model [subscriptions] and monetization packaging [bundled].

Now, the dominant monetization segments to be mastered will be the monetization strategy [metric, per use charging] and the monetization pricing segment [penetration, dynamic, skimming etc.]

This approach prompts a radical shift in the capability requirements of the Salesforce org. The move from a ‘set it and forget it price’ to a, dare I say, ‘agile’ without being trolled, pricing infrastructure will be the biggest challenge. Having read through some of the Intercom customer feedback from the Fin rollout, customers won’t be holding back when it comes to assessing ROI of the $2 per use Salesforce agents.

Assuming that this is the first of many agents, Salesforce will, at a minimum, need to develop capabilities to:

Track usage of agents

Experiment with ‘on the fly’ packaging

Provide customers with up to the minute costs via a console

Track compute costs per use to compare to pricing

Survey users and assess customer value creation

Test different pricing levels

The Road Ahead

Salesforce were ahead of the curve in seeing that AI agents are not only a new product, but also a new business and monetization model. To make it work, they’ll have to re-configure their monetization stack to avoid flying blind.