"What people think is unknowable. But what they do is undeniable."

1925

Imagine you're a military planner in 1925, and you're tasked with the job of equipping your country's defensive and offensive capabilities.

No one knows much about the use of tanks.

No one knows much about the emerging Air Force.

No one knows much about the potential of fighter planes on ships.

No one knows much about the electronic Radar.

No one knows much about the combination of these unknowables.

Pricing Unknowables

Most work in pricing is what many call 'Best Guess Estimates'.

Yes, we wrap pricing up in hallowed cloth and throw economics, science and data in the mix. But we all know it's best guess all the way.

Great companies seek to reduce. Or at least minimise the guesswork.

How?

By adding more tiers

By adding more features

By adding more product

By doing more surveys

By doing more math

By doing more surveys [yeah, I like surveys!]

By adding more features

I could go on.

But you get the picture.

Been there!

Done that!

The Leader of the Pack

As we speak, Salesforce sells 10+ cloud products (Sales, Marketing, Service, etc.). Each with 50 to 100 features.

HubSpot, a legend in its own right and a worthy rival, has five main Hubs (CRM, Marketing, Sales, Service, CMS), each with 40 to 80 features.

Assuming some core overlap, we can calculate that Salesforce may have over 400 unique features.

And Hubspot? Around 200+ unique features.

SaaS is Salesforce. And Salesforce is SaaS.

Salesforce is among the most successful 'Software as a Service' startups. Ever!

Salesforce is the granddaddy of SaaS.

Salesforce is SaaS. And SaaS is Salesforce.

Salesforce's Marc Benioff marked the move from your I.T. house to our I.T. house.

From 'On Premises' to Cloud.

And, it is this move that prompted the offering as a service, not an outright sale of Software that he had grown up with at Oracle.

And now, he is pioneering the move from SaaS to AAAS.

Sounds quite rude. But it's just the A replacing the S in SaaS to create AAAS. Yes, Agents as a Service.

Business Model vs Monetization Model

Sometimes, it's easy to distinguish between a business model and a monetization model. At other times, it is not so easy.

In the Salesforce scenario, it's clear. Software as a Service is the business model. And Subscriptions are the monetization model.

We tend to use these interchangeably.

But they are distinct. In that, serving Software from the cloud does not mean you have to charge monthly or by usage for that service.

That's just the way it went down. It was a strategic move by Salesforce to counter-position to the large upfronts required by CRM leaders at the time, including, Siebel.

Going All-in on Agents.

But now, Marc is going all-in on Ai agents. Why?

We cannot know what is going on in his head. But, from what he says out loud on then many recent podcasts is that:

1. Ai is a new software

2. Ai Agents are a new business model

3. A new business model can lead to a new monetization model

4. His first stab at a new monetization model is $2 per action Ai Agents.

Is he right? Or Wrong?

Who knows. But Marc is determined not to be disrupted the way he disrupted Siebel. And that means the whole SaaS industry is determined, too!

What is going on here? The 5% SaaS Hole

SaaS and subscriptions are the default business and monetization models within tech.

But beneath the surface lies some fundamental problems.

I call it the '5% SaaS Hole.'

Every week, Jamin Ball publishes sobering SaaS margin facts.

Here's a highlight:

Public SaaS Industry Operating Metrics

Median S&M % Revenue: 41%

Median R&D % Revenue: 25%

Median G&A % Revenue: 17%

In simple terms, the average SaaS spends 41 cents on every $1 of revenue in sales and marketing.

And 25 cents on research and development.

And 17 cents on general admin.

I've read these jarring numbers on his Substack, 'Clouded Judgement,' for the last few months.

Little has changed.

But quarter after quarter, the Big Three cloud providers pump out revenue growth.

And we know all about Meta's and Google's Ad revenue growth!

A Rock and a Hard Place

In the early 1920s, copper miners working in Arizona were caught between:

A "rock" - the dangerous, physically demanding work in copper mines and

A "hard place" - the threat of being fired if they complained about working conditions

One hundred years on, SaaS companies aren't breaking any rocks or doing any mining, but they face a similar rock.

And a very hard place!

No profits!

The Cloud Platforms and Ad Platforms have them caught in a vice. You might call it a ‘SaaS’ sandwich

The SaaS Sandwich 🥪

Ai?

What about Ai?

I hear you ask.

Well, with Ai, infra costs will go up in the short term.

And, Ad Costs?

Who knows?

Maybe up. Ai increases the number of startups.

Maybe down. Ai helps optimize Ads.

So what?

SaaS has two obvious choices:

1. Optimize the old.

2. Originate the new

In Finance, we're taught that the numbers don't lie.

(Unless, of course, we've prepared them to deceive)

Jamin's numbers are there for all to see.

SaaS is a great rental business model. But with too many superior landlords!!!

"There is nothing more powerful than an idea whose time has come.” And that idea is Ai agents.

What may be required is the re-configuration of existing Products and Features into Agents.

No, not just because it's the latest bro speak in the valley.

But because it's the easiest way to escape the SaaS pricing prison that most startups find themselves locked in.

Yes, Cinderella. You can go to the Ball.

We spoke about the dizzying number of products and features offered by every large SaaS company.

This is a problem. Or, should I say, it was a problem.

Then along came LLMs. And then Agents.

But why does this solve the feature-fog problem?

Ai Agents re-package features into jobs.

- Specific jobs.

- Marketable jobs.

- Monetizeable jobs.

For want of a better word, let's call it: 'JobsFormation'.

The Jobsformation of SaaS.

This works because:

1. Features are Atomic Units of Product Value.

2. More Experimentation is better than less.

3. Experiments are best broken down into observable chunks.

4. Finding one value metric is hard.

5. Jobs led pricing enables multiple price points and value metrics.

We may not have billions of agents as Salesforce suggests.

But, most SaaS products have at least eight to ten 'Cinderella' features that should be packaged into Ai Agents.

So as a thought experiment, I asked ChatGPT

"Can you think of a 'Cinderella' feature…(i.e. brilliant but not high up the feature hierarchy)….within the Enterprise plan that basic plan users would buy as an Add-on if it was offered as an Ai agent.

How much could they charge for this add-on?"

And this is what it said:

▪️A strong candidate for a "Cinderella" feature within Salesforce's Enterprise plan could be:

" Advanced Reporting & Dashboards."

Maybe enhanced with Ai.

Why?

▪️Problem:

Basic plan users lack advanced analytics and real-time insights but need actionable data.

▪️Solution:

An AI Agent that delivers proactive insights

(e.g., "sales team X is underperforming by 10% compared to benchmarks" or "predictive forecast suggests you'll miss your quarterly target without additional pipeline growth").

▪️Monetization Potential

- Price it as a per-user add-on or per action, reflecting both scalability and affordability for smaller teams.

- Suggested Pricing: $40 per user per month or 50 actions or insights

Now, this was just a short experiment to prove the point. But it sets the stage for a new monetization model. Jobs Led Pricing.

Jobs Led Pricing

Following Marc's category creating 'on-prem vs cloud' distinction, we could label the current SaaS pricing as Blob Pricing.

Blob pricing in that it attempts to herd thousands of customers into three or four pricing tiers. Blobs as it were.

But what is a job anyways?

In the Jobs-to-Be-Done (JTBD) framework, a "job" refers to the specific task or goal a customer tries to accomplish when using a product or service. [wikipedia]

People buy software to do hundreds of different jobs.

But the software bundles all these jobs into 3 or 4 pricing packages.

This is the problem.

The software is made generic.

The human takes that generic software and makes it specific to their job.

Ai agents can turn the generic to specific.

And hence can be priced as such.

Ai Agents: From Blob Pricing to Job Pricing

The JobsFormation of SaaS Pricing Plans.

Some things just go together:

- Love and marriage

- Horse and carriage

- EVs and Subsidies, And

- SaaS and Pricing Plans.

But Google Ads doesn't have Pricing Plans.

Nor does Meta!

They have Prices.

Yes.

But no published pricing plans.

Ai Agents are more likely than not to change Pricing Plans.

From three or four tier blobs to many jobs.

The JobsFormation of SaaS.

After all…

…who needs 'Blob Segments' when you can have 'Job Segments'.

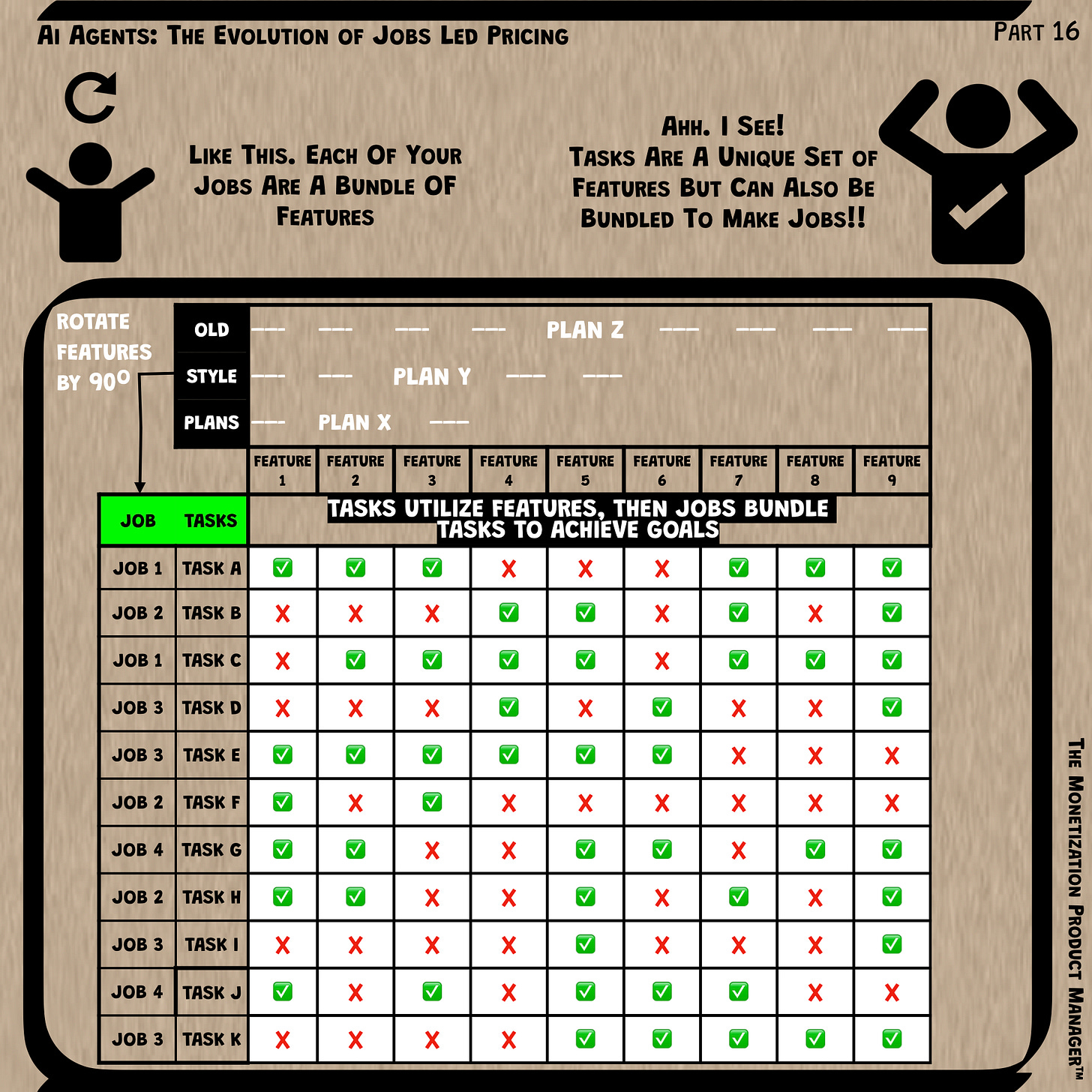

Ai Agent Jobs Led Pricing turns:

🔲 Features bundle into Tasks

🔲 Tasks bundle into Jobs

🔲 Jobs then - Go To Market and Price - as Agents.

Most products proudly display nine or so features above the fold.

Of course, there are many more.

But let's focus on the top 9 for now.

Think of the top 10 tasks that your customers do with these features.

Select and deselect the features required for that task. And then the next. And so on.

Then, assign each task to a Job number.

Then, Price and Market the Job. Fancy product name optional.

Nobody at Google or Meta talks Pricing.

Of course, they do price. Or monetize, as they say.

But they don't talk about price points.

Why?

Because they have thousands.

Hundreds of thousands per year.

Millions even.

Each CPM.

Each CPA.

Each CPC.

Each C acronym is another price point.

I suppose you could call each action an agent.

A marketing agent that is specifically tasked with a unique job like conversion, sign up, purchase etc.

Yes. Google and Meta have always had agents.

And that's how they're able to monetize so effectively.

But it's a fact.

Monopolies (alleged) don't talk bbout Pricing or Monetization!

Just like in the Fight Club:

The 1st Rule of Fight Club, is that no one talks about Fight Club!

And the first rule of monopoly ["allegedly", always important to get that out there 😁 ] is that no one talks about Monetization, Pricing or Value Capture!

I mean no-one! Omerta or what!

You can count on two hands how many Podcasts or YouTubes that feature real people that have actually worked in Monetization at Meta...

And are prepared to tell the tale. [Chamath, aside, of course!]

So either:

1. They allocate very few resources and just monetize by magic whilst pricing millions of Ad units, products and features per day. [I think that's what they call 100X engineers 💪]

Or...

2. They have a sh*t ton of resources allocated to monetization under different, more obscure names, like analytics, business intelligence, performance optimization etc

Can't be 100% sure, but I wager, it's more like the latter.

A back of the envelope for Meta's Engineering Monetization resource allocation using Ai, Linkedin and plain old Google shows that they most likely dedicate over 10% (7,000+) of its workforce to Monetization efforts.

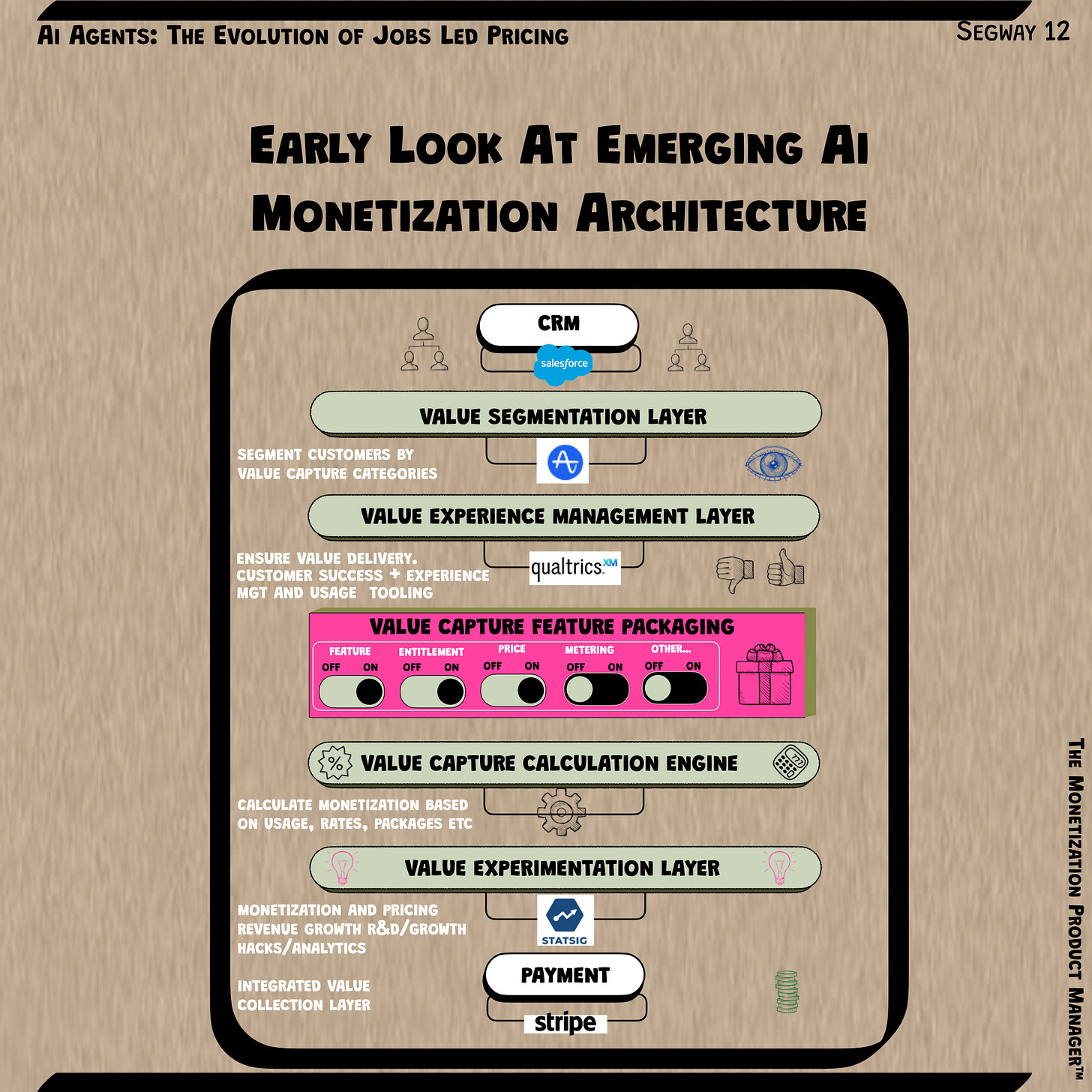

Ai Agents enable SaaS companies to leverage LLMs with a new business model and monetization model to replicate Google and Meta's monetization machine. But they’ll have to think about re-engineering their Monetization stack to achieve this.