How much?

This question bedevils all businesses.

How much to charge?

How much resources do you need to deploy?

How much value have we created?

How much value can we capture?

The question of how much is the crux.

The crux of the strategy.

The crux of the business model.

And the crux of success!

But what is value creation?

We've talked about how value creation is the process of enhancing the value of a product, service, or thing such that its value exceeds its costs.

But how do you measure that?

But before we dive down the rabbit hole of value creation measurement, let's ask why measuring is essential in the first place.

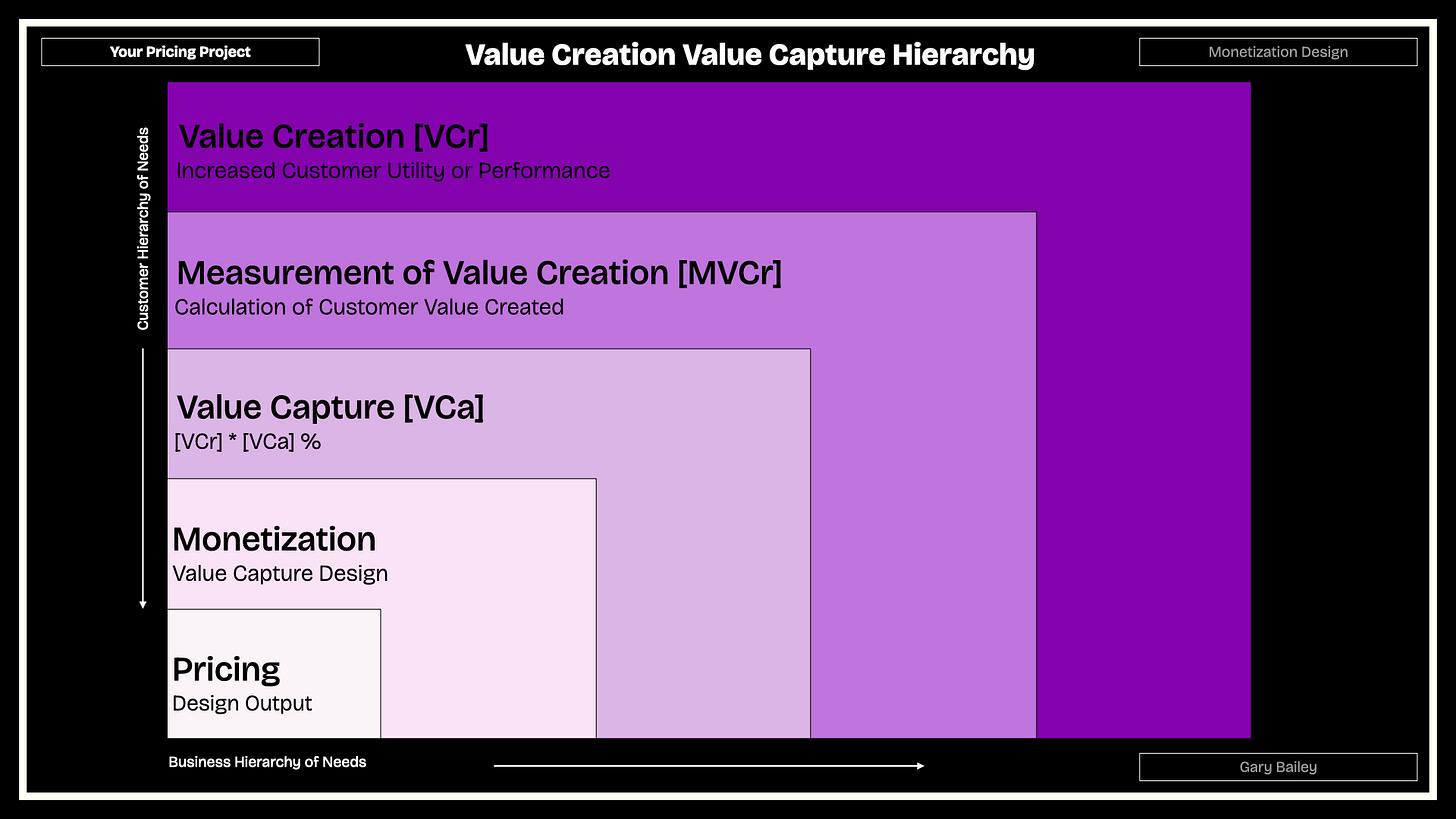

Most companies think they have a monetization problem.

But what they have is either one or all of these problems:

a. a value creation problem

b. an ability to measure that value creation

c. an inability to communicate that value creation to customers or clients

Monetization rests on the shoulders of the creation, calculation and communication of value creation.

The Measurement of Value Creation

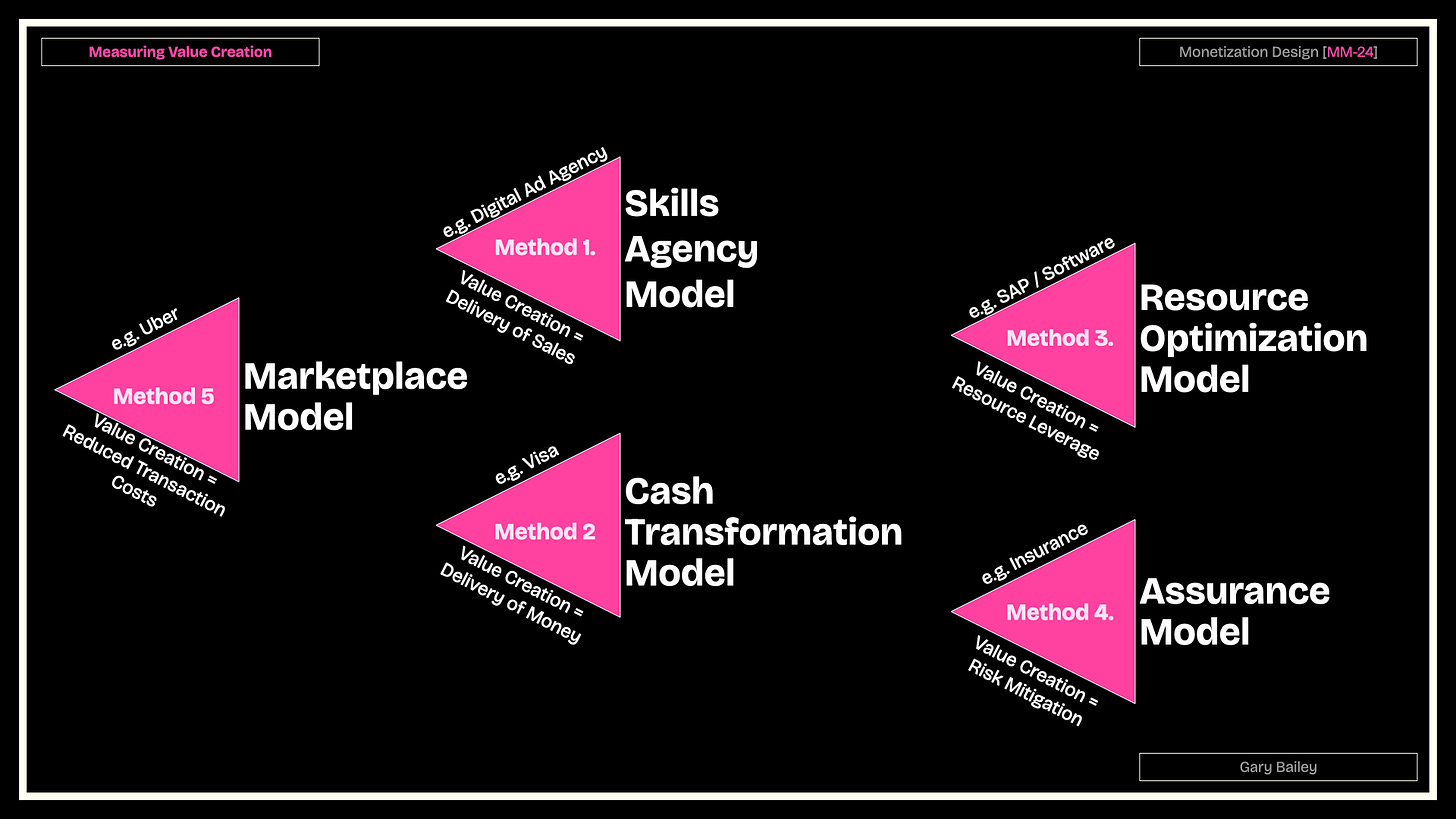

Let's go through five main measurement models:

The Skills Agency Model

The Cash Take Transformation Model

The Resource Optimization Model

The Assurance Model

The Marketplace Model

The Skills Agency Model Measurement Model

The skills agency model is perhaps the simplest.

I give you a plum, and you 'return me a peach' kind of thing.

In this sense, the plum is generally cash or spend, and the peach is a return on that cash or spend.

Digital Advertising Agencies are the best example of this measurement model.

$100 given to a skilled Meta/Facebook agency should result in $300 of revenue. That's a 3X return.

Or, a $200 incremental return is another way to put it.

This measure is, therefore, clean and easy.

I give you $100, and you give me back $300.

$200 of value creation.

The Cash Take Transformation Model Measurement Model

The Cash Take Transformation Model is equally as simple. They take cash from one form and deliver it to another.

The best example is a Visa card.

Visa takes your money and transforms it into the same or foreign currency to deliver to a third party. Say, a retailer or vendor.

A $100 transaction represents $100 of value creation for the vendor. A sale that they may not have made without the Visa card enablement.

Resource Optimization Measurement Model

The Resource Optimization Model relies on creating value by improving the use of an existing asset.

This applies to any capital. Think talent capital, physical plant capital, cash capital or equity capital.

This is where most software lies, particularly productivity software such as Excel, Notion, Powerpoint, etc.

But the best example of this category would be ERPs. Enterprise Resource Planning software such as SAP.

They create value by enabling you to run payroll or manage assets better.

For instance, if you're managing $100m in assets/resources and planning helps you optimize by just 1%, they've delivered $1m of value creation.

Assurance Measurement Model

Risk management is valuable. Value is created by negating these risks.

Insurance is the best example of value creation by negating threats.

Value is created by allowing you to conduct a certain type of business activity in the knowledge that extreme downside risks are covered.

Marketplace Measurement Model

The goal of a marketplace is to reduce transaction costs, which are the transaction costs of supply meeting demand, sellers finding buyers, and the reverse.

Reduced transactions create value for one or both parties. The costs of these transactions could be time, stress, money, etc.

Summary

The measurement of value capture is the most important step in your pricing project.

We'll use these foundational models and more to create examples around different industry monetization models, including Ai apps and products.

This is a neat framework!